Intelligent Chargeback Management Software

Are you looking for industry experts who can assist you in preventing and fighting chargebacks with the highest ROI? Rocket Metrics helps you navigate the chargeback process, streamline chargeback issues, decrease fraudulent activity, and enhance customer experience.

Chargeback Protection for Merchants

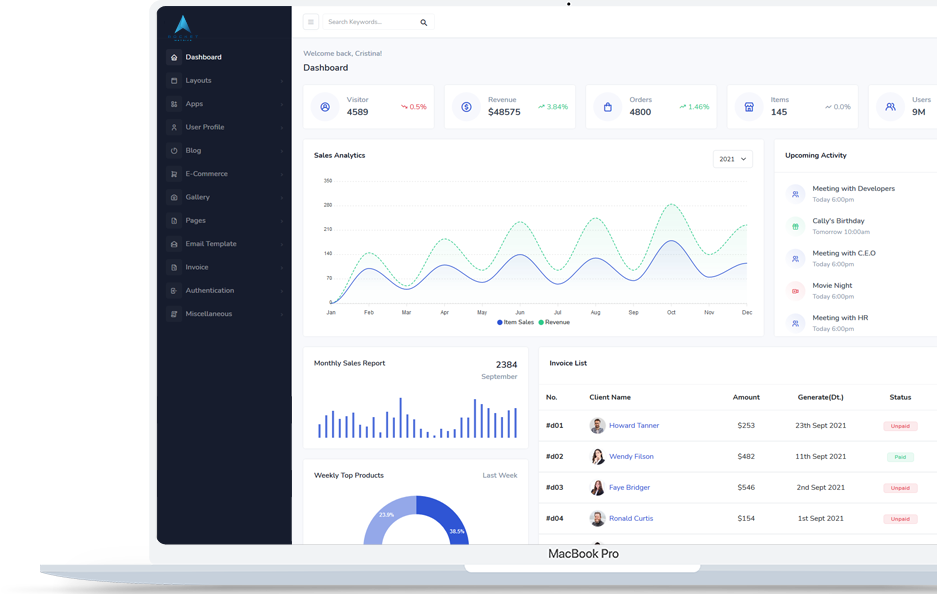

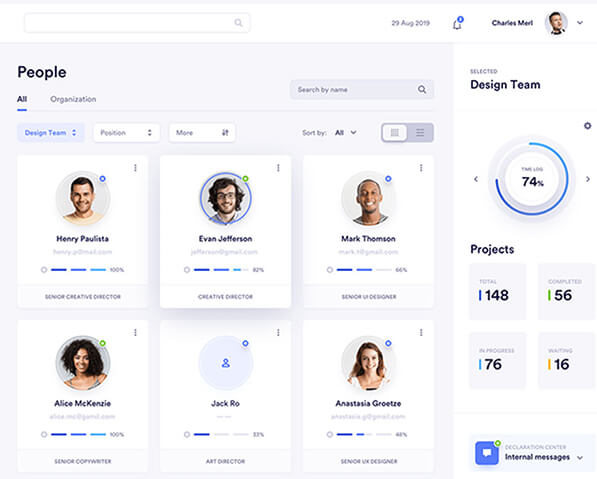

Chargeback Analytics

Our advanced technology aggregates important information from all your service providers. This helps you in analyzing and pinpointing the source of your chargebacks. Learn More →

Chargeback Testing & Monitoring

We evaluate all debit and credit card descriptions in advance. Our team monitors the accounts of business merchants every day. Learn More →

Chargeback Representment

Every chargeback is reviewed manually. Then, the information and evidence are collected. This is sent to the bank re-presentments to demonstrate that the transaction is completely legitimate. Learn More →

Rapid Dispute Resolution

Rocket Metrics provides you with instant dispute resolution as it significantly decreases unwanted chargebacks. In addition, it also prevents merchants’ chargeback ratio from going overboard. Learn More →

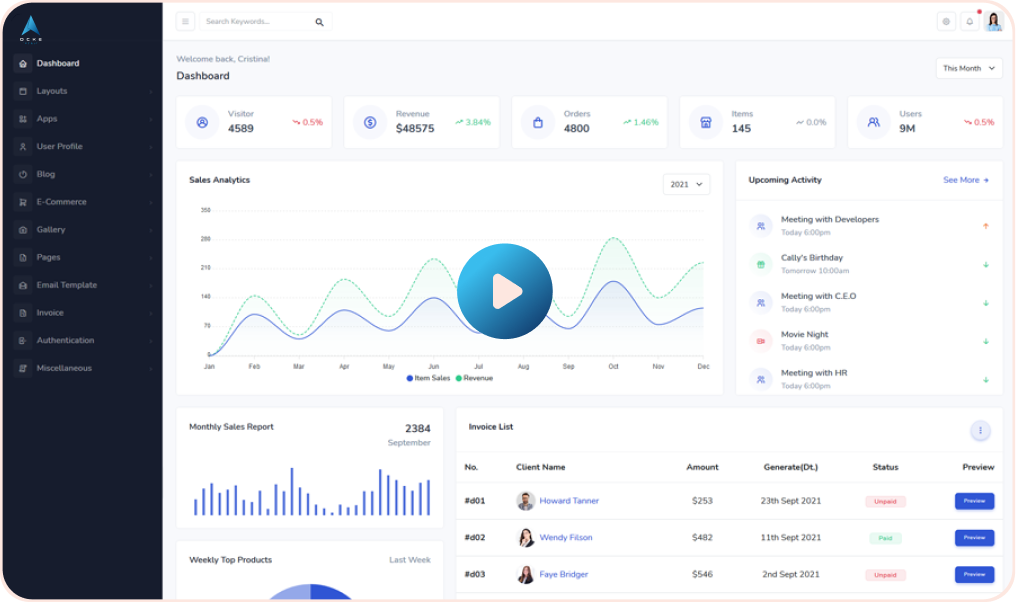

Connect with Leading

Payment Industry Experts

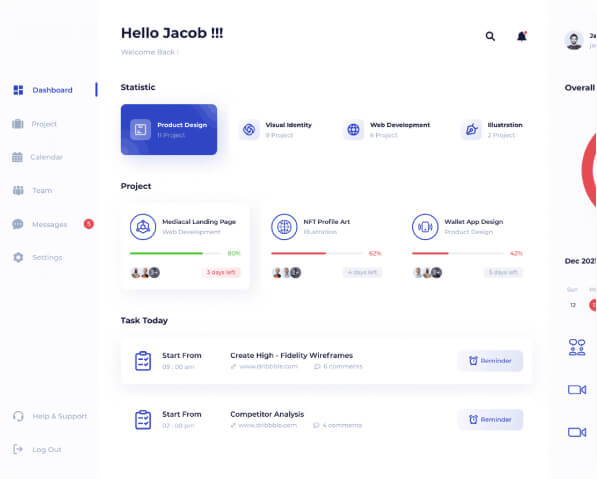

Why Choose rocket metrics

Fight Chargeback & Recover ROI

Order information & dispute data sync

We make sure that chargebacks are matched with the original order received. This helps analyze compelling evidence while offering transparent reporting.

Intelligent Chargeback Responses

We are pros at optimizing ROI, customizing responses with a reason code, and help you spend less while recovering more.

Advanced Automation

You can now manage chargeback responses efficiently thereby reducing labor-intensive and time-consuming tasks.

What do People Have to Say?

We have relied on Rocket Metrics and this has been one of the best decisions so far. They have helped in keeping our merchant's account clean and healthy. The team is supportive and friendly.

Rocket Metrics helps in enhancing the chargeback numbers. The team helped us stay compliant. We are very happy with the customer experience provided to us. We would recommend them to everyone.

Rocket Metrics has played a very important role in reducing the chargebacks for all our clients. We were able to set up everything quickly and started getting results of decreased chargeback counts.

Frequently

Asked Questions

Well, the customers are not always right so there may be fraudulent cases that negatively impact your bottom line. Therefore, fighting for chargebacks is time-consuming and complicated, so merchants don’t fight for chargebacks that are wrongly issued. It is mandatory for you to understand the whole process in detail and how it will help you. This gives your organization a huge boost in keeping your customers accountable for the actions they perform.

There are a few scenarios to consider. You may receive a chargeback when the cardholder or the bank taking side of the cardholder states:

- Used incorrect currency code

- Shipped products that were not required.

- Multiple time transaction submission

- Wrong amount submission

- Transaction wasn’t processed on time

- Failed to ship the merchandise question

However, it is important to keep the process consistent. Therefore the cardholder and merchant are not kept in limbo. Although the time limit has a positive impact, but it makes it challenging for the merchant to fight back. This is because he has to run his current b business and always be on his toes when it comes to the chargeback process.