Chargeback Analytics Management

API Integration

Pulls chargeback and alert information from your providers in an automatic manner.

Integrated Management

Do not log into multiple portals. Organize all of your chargeback information.

Detailed Analytics & Insights

Identify and address the vulnerabilities that are causing your chargeback rates to rise.

Actionable Reports

The chargeback report can be downloaded in just a few seconds into an Excel or PDF file.

Chargeback Analytics?

Practical Implications

- Utilize BIN analytics to resolve duplicate chargeback issues.

- Provide your accounting department with the refunds provided by your alerts provider.

- Provide authoritative data on refunds, decline/accept rates and chargeback amounts from gateway processors that can be used for accounting purposes.

- Let us contact alerts providers and request refunds for duplicate alerts, which will be credited to your account on a monthly basis.

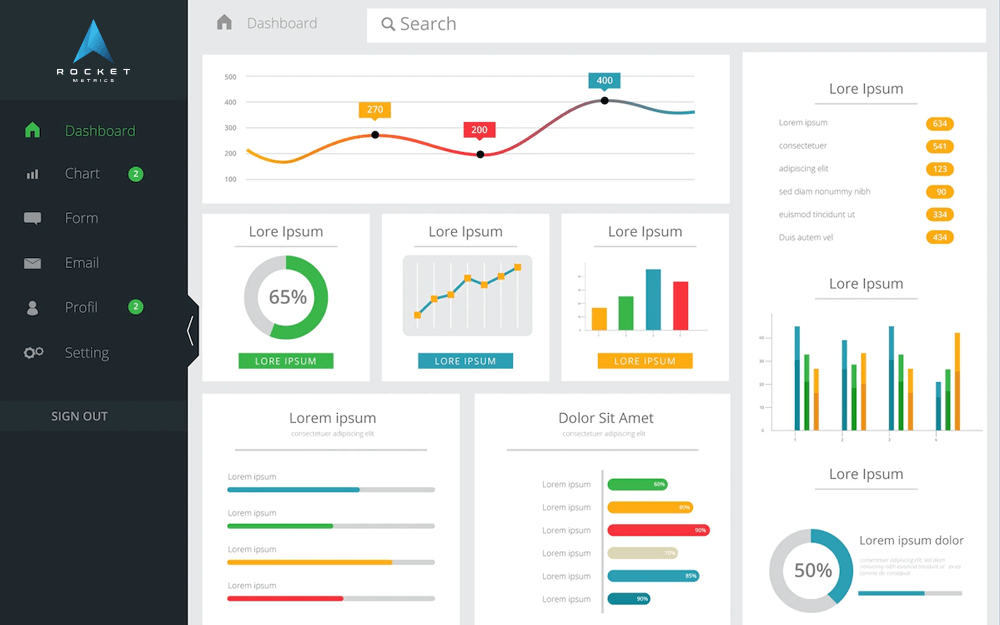

Chargeback Analytics

Your Data Your Way

Provide chargebacks, prevention alerts, and refunds according to the following factors: BIN, company, issuing bank, price point, date, and process sequence.

Get Geeky with It

Easily navigate through details or see your entire chargeback ecosystem from a bird's eye perspective.

Alerts Analytics

Filter chargeback alerts by descriptor, acceptance rate, alert provider and win rate.

Export Reports

View or export MID health, MID overview, and other chargeback reports in CSV or Excel file.

Accounting

Discover a variety of accounting reports and analytics, including cash accounting and accrual accounting.

Reduce Chargebacks

You can identify fraud problems before they become chargebacks by using chargeback analytics.

Frequently

Asked Questions

A reputable third-party alerts provider offers solutions for issues like duplicate notifications and makes it simpler to organize and handle alerts. Additionally, third-party alerts and other chargeback management solutions can be bundled together on a single platform.