Chargeback Rapid Dispute Resolution

Optimized RDR

Automatic resolution of disputes before they convert to chargebacks .

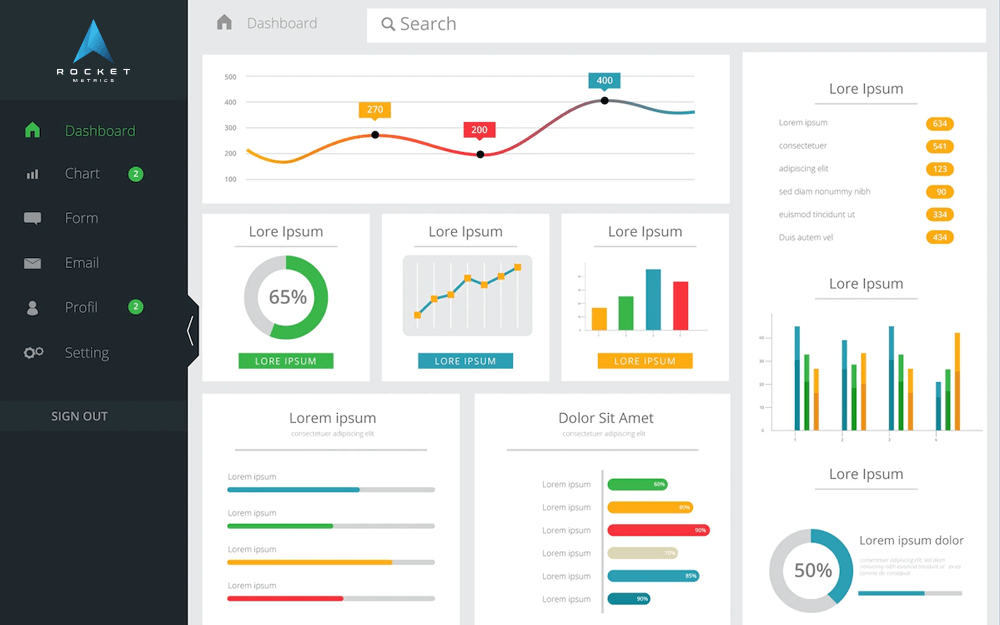

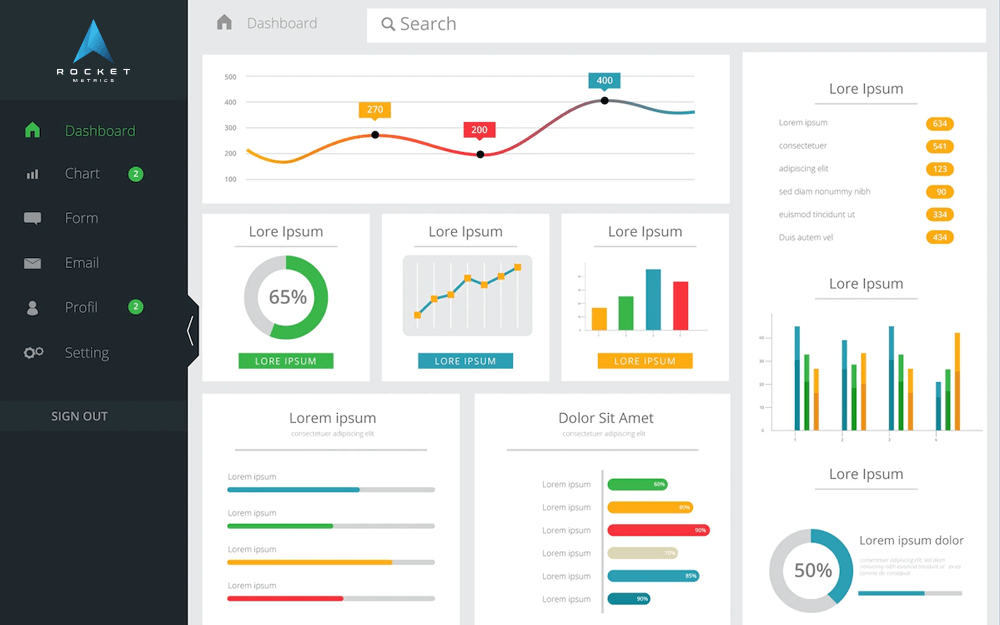

All-in-one Platform

On a single platform, RDRs, chargeback prevention alerts, representations, and analytics.

Deep Analytics & Insights

View your complete portfolio's performance of RDRs. Analyze data by issuer and acquirer.

Actionable Reports

Rapid Dispute Resolution reports can be downloaded in Excel or PDF file format within seconds.

Rapid Dispute Resolution?

Choose Rocket metrics?

Our Key Features

Automatic

RDR prevents disputes to become chargebacks by responding automatically.

Custom Parameters

Set rules and guidelines based on the dispute category, dispute condition code, purchase identification, currency code, and transaction date and amount.

Analytics

Due to RDR’s integration with Rocket Metrics analytics dashboard get deep insights into dispute responses. Check RDR analytics by issuer and acquirer.

Frequently

Asked Questions

A reputable third-party alerts provider offers solutions for issues like duplicate notifications and makes it simpler to organize and handle alerts. Additionally, third-party alerts and other chargeback management solutions can be bundled together on a single platform.